The Nebraska agency contact information is: Department of Revenue, Nebraska State Office Building, 301 Centennial Mall South, P.O. File 1099 forms or file 1095 forms today with eFileMyFormss trademarked 1099 eFile & 1095 eFile service Quality, Security, and Dependability since 2001. The IRS mailing address for Nebraska filers is: Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999. E-File 1099s online & e-file 1095s online with our IRS approved services for printing, mailing, and eFiling 1095, 1098, 1099 (inc. Early Withdrawal Penalty Form 1099-K Box 3. Data import requires W2 Mate option 3 in addition to the basic W2 Mate software. Per-Unit Retain Allocations Form 1099-OID Box 3. Import 1099-NEC recipient information, dollar amounts and email addresses from Excel, Intuit QuickBooks, Sage, MS Dynamics, Jasteck, and other sources. If you aren’t 100 satisfied with this item you may return it or exchange it for free. Fair Market Value (FMV) of Property Form 1099-PATR Box 3. 1099-MISC tax form for payments, such as miscellaneous income made in the course of a trade or business. For checks printed with other programs, order envelope 40-338. I do not know if I can give it to my employees on plain paper, if so why would I have needed the forms I ordered.

1099 blank forms in office max quickbooks free#

Each kit contains: 2021 1099-NEC forms (three tax forms per page) four free 1096 forms. I am trying to get everything printed out. Use federal 1099-NEC tax forms to report payments of 600 or more to non-employees (contractors). I ordered the W-2 forms but it doesnt want to print just the information in the boxes it wants to print the whole thing. For checks printed with Checksoft, order envelope 40-325. I am trying to print my W2s for my employees. Adjustments to Scholarships or Grants for a Prior Year Form 1099-C Box 7. Compatible with Checksoft Home & Business, Checksoft Premier and Checksoft Platinum, Quicken, QuickBooks, VersaCheck, MS Small Business Accounting and MS Money.

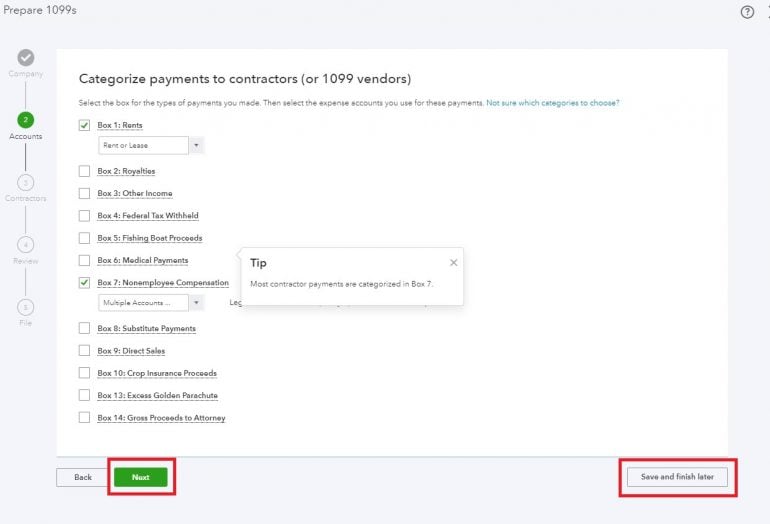

Sample 1099 boxes that can be reported to the IRS / Nebraska using W2 Mate® software: Form 1099-INT Box 1. To contact Nebraska Department of Revenue call 40. The QuickBooks modules enable you to monitor new events, or create, update, retrieve and delete invoices, bills, sales receipts, estimates, journal entries.

1099 blank forms in office max quickbooks software#

If you file 250 or more 1099 returns with the Internal Revenue Service you must file electronically and utilize a software that complies with publication 1220. Businesses must send this form to the IRS by January 31st, regardless of whether it is filed electronically or by mail. Unless many other 1099 forms, the due date does not vary based on how it is filed with the Internal Revenue Service.

If you file 50 or more 1099 forms with Nebraska you must file electronically. The second due date for form 1099-NEC is when it must be provided to the IRS. The Fed paper form must be filed by Tuesday February 28,2020. Report payment information to the IRS and the person or business that received the payment.Nebraska 1099 filers must send the 2018 1099 state copy to the NE department of revenue by February 28,2020.Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600 or more made in the course of a trade or business in rents or for other specified purposes (Form 1099-MISC).Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099-NEC).Payers use Form 1099-MISC, Miscellaneous Information or Form 1099-NEC, Nonemployee Compensation to: The Social Security Administration shares the information with the Internal Revenue Service. Report the employee's income and social security taxes withheld and other information.Įmployers furnish the Form W-2 to the employee and the Social Security Administration. Product Details QuickBooks® Compatible 1099-MISC Tax Forms Kit with Envelopes.Report wages, tips, and other compensation paid to an employee.Although these forms are called information returns, they serve different functions.Įmployers use Form W-2, Wage and Tax Statement to:

0 kommentar(er)

0 kommentar(er)